Examples

As illustrations of switching regression estimation, we consider three examples: Hamilton’s (1989) MSAR(4) specification for post-war U.S. GNP, Kim and Nelson’s (1999) example of a time-varying transition probability model of industrial production, and Kim and Nelson’s (1999) three state Markov model of regime heteroskedasticity.

Markov Switching AR

Hamilton (1989) specifies a two-state Markov switching model in which the mean growth rate of GNP is subject to regime switching, and where the errors follow a regime-invariant AR(4) process. The data for this example, which consists of the series G containing (100 times) the log difference of quarterly U.S. GNP for 1951q1–1984q4, may be found in the workfile “GNP_hamilton.WF1”.

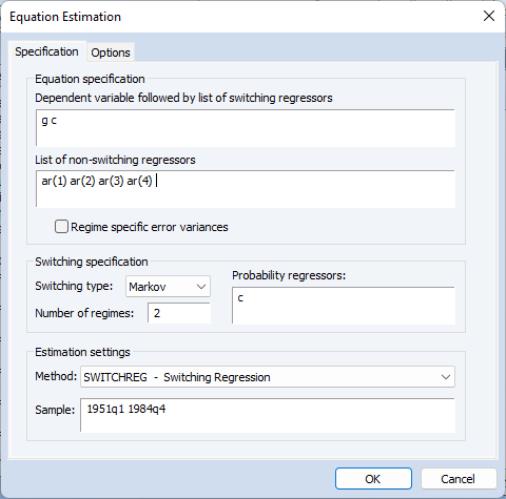

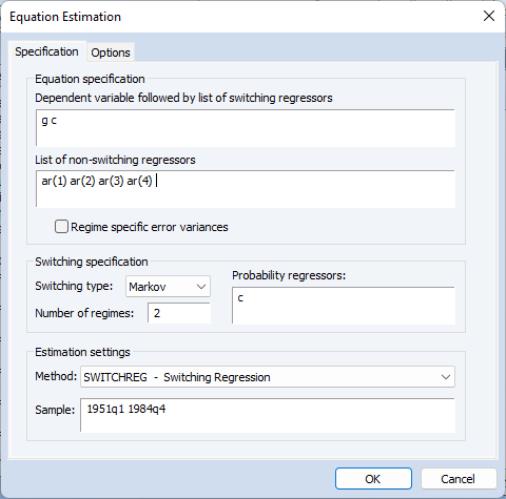

To estimate the Hamilton model, open an switching equation dialog and enter the specification as depicted below:

The equation specification consists of a two-state Markov switching model with a single switching mean regressor C and the four non-switching AR terms. The error variance is assumed to be common across the regimes. The only probability regressor is the constant C since we have time-invariant regime transition probabilities.

With the exception of the convergence tolerance which we set to 1e-8, we leave the rest of the settings at their default values. Click on to estimate the equation and display the estimation results.

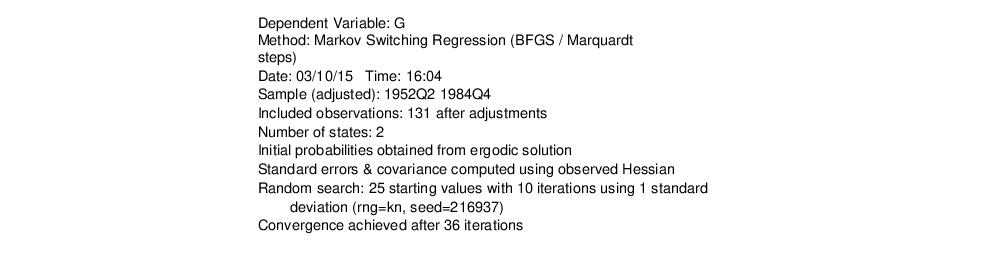

The top portion of the output describes the estimation settings:

(Bear in mind that if you attempt replicate this estimation using the default settings, you may obtain different results due to the different set of random starting values. You may use the random number generator seed settings to obtain the same starting values.)

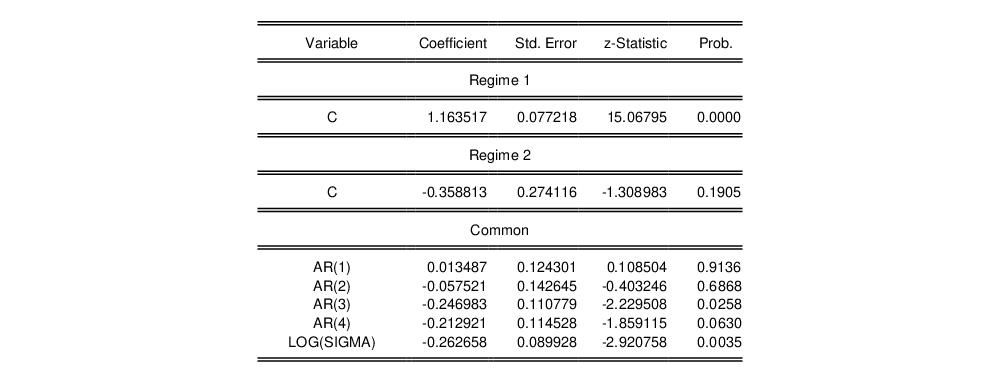

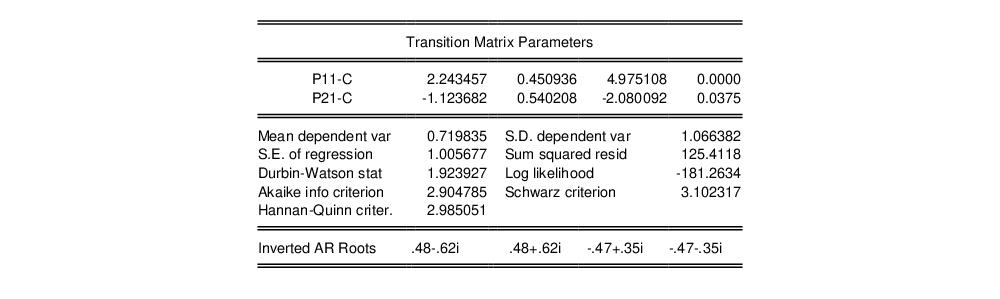

The middle section displays the coefficients for the regime specific mean and the invariant error distribution coefficients. We see, in the differences in the regime specific means, what Hamilton terms the fast and slow growth rates for the U.S. economy.

The remaining results show the parameters of the transition matrix and summary statistics for the estimated equation.

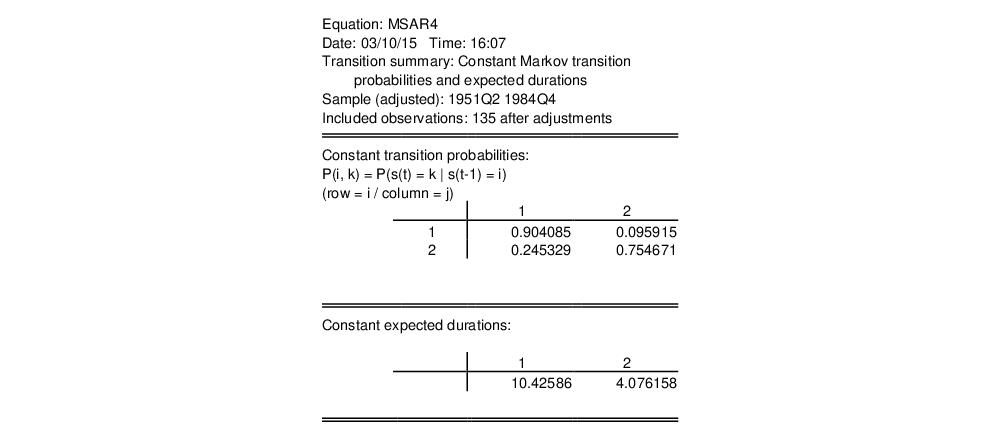

Instead of focusing on the transition matrix parameters, we examine the transition matrix probabilities directly by selecting and clicking on to display the default summary view:

Here, we see the transition probability matrix and the expected durations. Note that there is considerable state dependence in the transition probabilities with a relatively higher probability of remaining in the origin regime (0.90 for the high output state, 0.75 for the low output state). The corresponding expected durations in a regime are approximately 10.4 and 4.1 quarters, respectively.

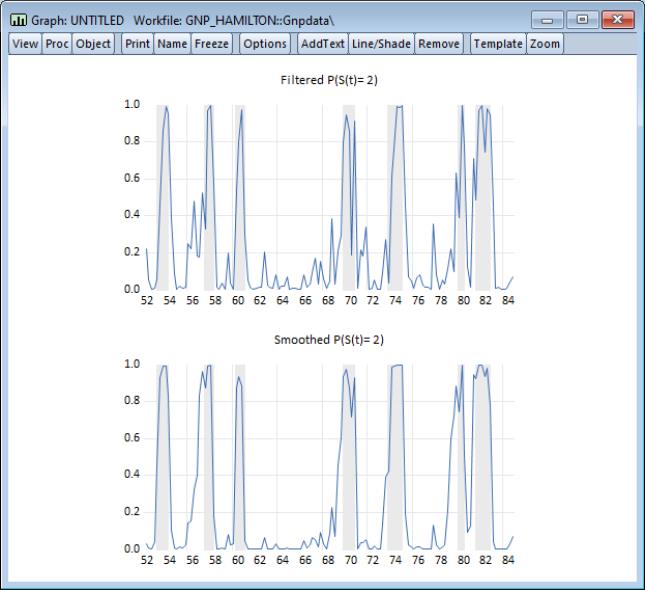

Lastly, we display the filtered and full sample estimates of the probabilities of being in the two regimes. First select and choose the filtered results. We will display the results only for the first regime. Then repeat the procedure choosing the smoothed results.

After saving the two views as graphs, editing the labels, and applying the RecShade add-in (

http://www.eviews.com/Addins/addins.shtml) to label the NBER recessions, we see that the predicted probabilities of being in the low output state coincide nicely with the commonly employed definition of recessions:

Time-Varying Transitions

Kim and Nelson (1999, p. 93) provide example data for estimating an MSAR(4) model with time-varying transition probabilities, as in Filardo (1994). Filardo models the log growth rate of industrial production (DLOGIP) using an MSAR(4) switching mean specification, using (among other variables) the log growth rate of the Composite Index of Eleven Leading Indicators (DLOGIDX) as a business-cycle predictor.

The Kim and Nelson monthly data for 1948m01 to 1991m04 are included the workfile “kimnelson_tvp.WF1”. Note that these data correspond to, but differ slightly from the data used in Filardo (1994).

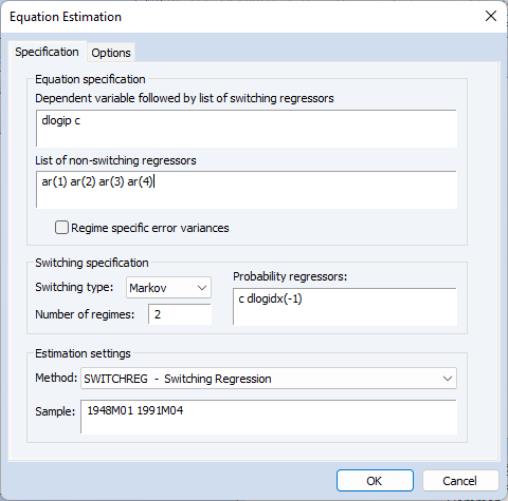

We open the switching regression dialog and fill out the tab with the switching mean AR(4) spec and the switching probability specification:

Note that use have used the lag of the leading indicator variable as our probability regressor so that the period

data for the regressor corresponds to the values influencing the transitions for

to

.

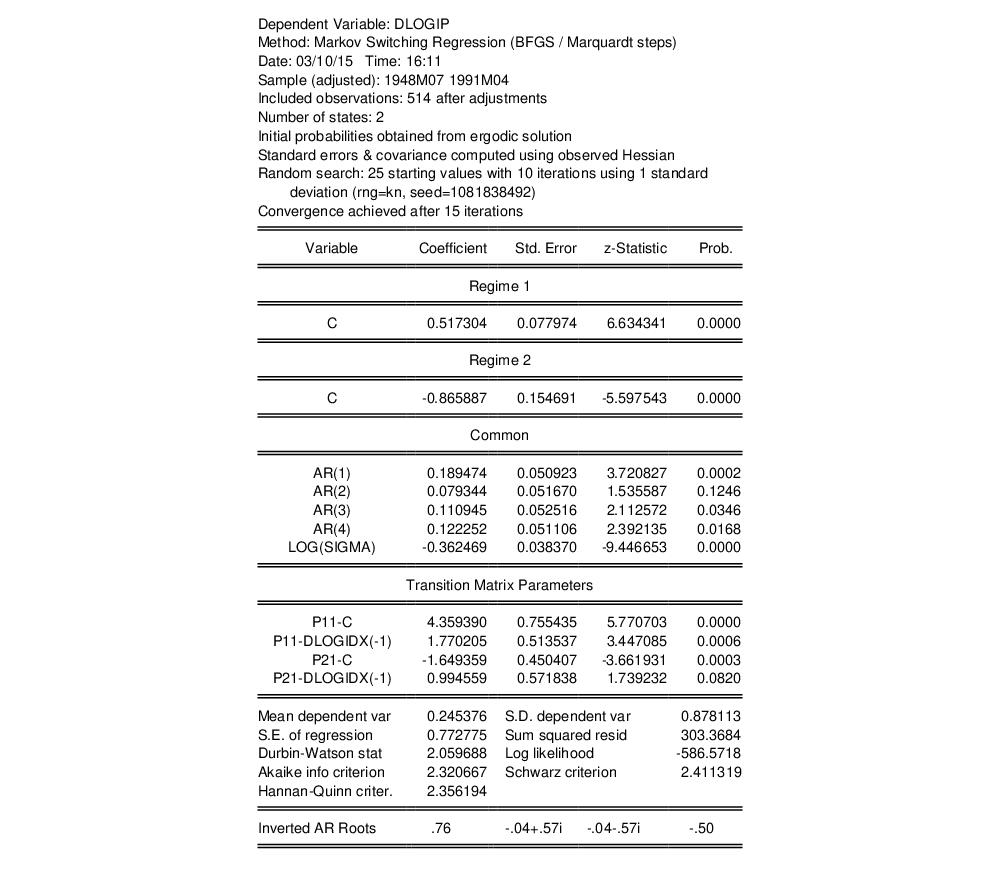

We leave the remaining settings at their defaults and click on to estimate the equation. Following estimation, EViews displays the results:

The results are broadly similar to, but differ slightly from those reported by Filardo. The coefficients on the intercept in the mean equation both differ from zero with opposite (statistically significant) signs. As to the transition matrix parameters, we see that increases in the log growth rate are associated with higher probabilities of being in the high production growth regime, lowering the transition probability out of regime 1 and increasing the transition probability from regime 2 into regime 1.

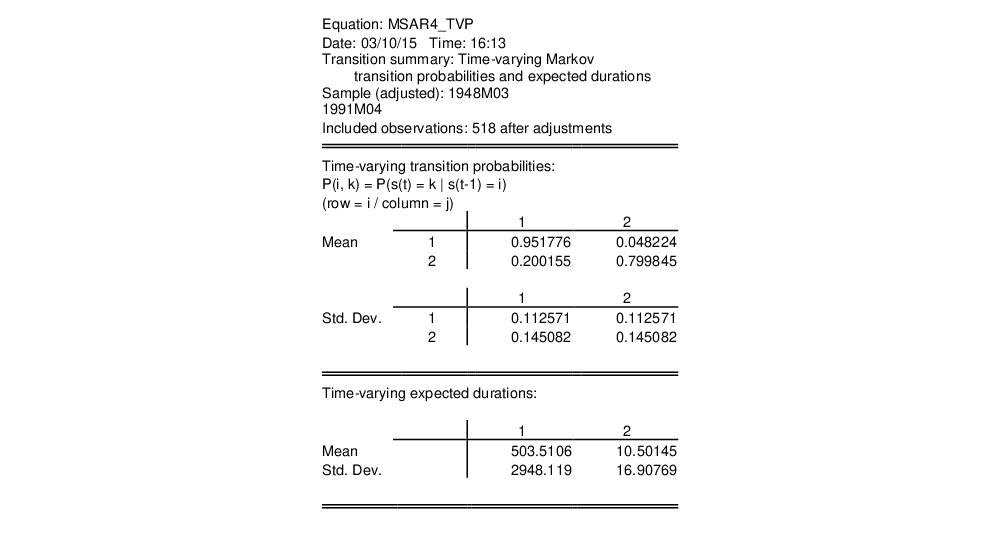

We can examine more directly the transition probabilities. The default transition probability summary () shows descriptive statistics for the elements of the transition matrix:

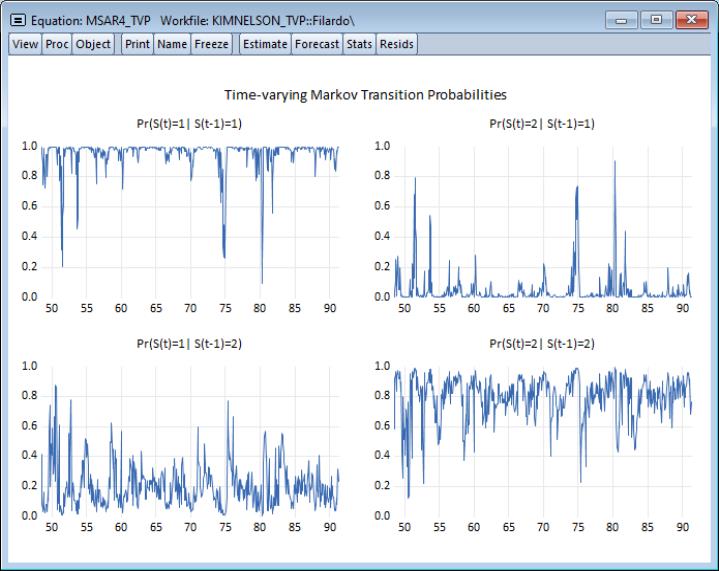

We can see the variation in the time-varying probabilities by examining graphs of the transition probabilities for each observation. Select and click on the radio button. The default view for showing the probabilities is a graph so you may simply click on to show graphs for all four probabilities.

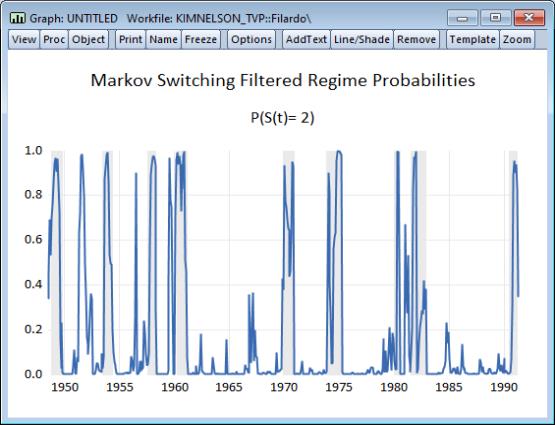

The filtered probabilities of being in the low production regime are presented below, with NBER recession shading.

To create this graph, select , select the radio button and enter “2” in the edit field to only show the second (low production) regime.

Click on to display the graph view, then click on the button to save the view as a graph object. Select in the graph menu (you must first install the RecShade Add-in to use the automatic shading feature:

Regime Heteroskedasticity

Kim and Nelson (1999) offer an example (Section 4.6, p. 86) of a three state Markov switching model of regime heteroskedastic stock returns from 1926m1–1986m12. The data, which consist of monthly CRSP equal-weighted excess returns are in the series EXCESS, provided in the workfile “ew_excs.WF1”.

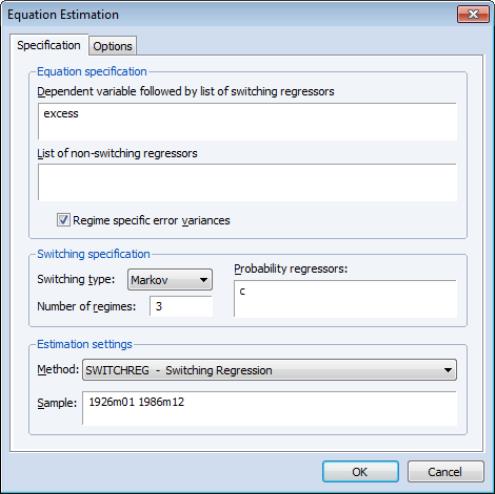

The specification of the model is as depicted in the dialog below:

The excess returns are assumed to have mean zero so we enter only the name of the dependent variable in the topmost edit field. Since we wish to model regime heteroskedasticity, box is checked. The model assumes Markov switching probabilities with 3 regimes and constant transition probabilities.

Preliminary analysis indicates that this model is particularly difficult to estimate with a number of local roots exhibiting coefficient singularity.

To obtain estimates we instruct EViews to perform extra randomized starting value estimation. Click on the tab and change the starting value settings so EViews generates 200 sets of random starts (instead of 25) with 50 (instead of 10) iteration refinements. Set the convergence tolerance to 1e-5. You may need to set the random seed as depicted below. Click on to proceed with the estimation.

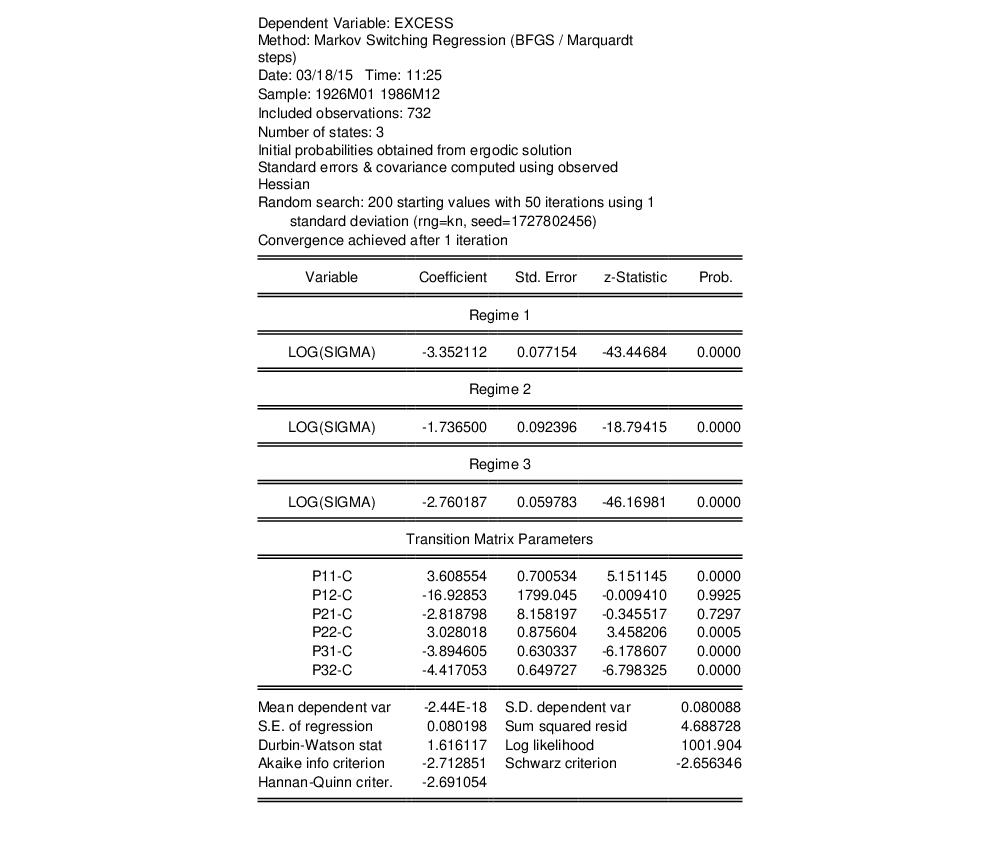

EViews estimates the model and displays the standard switching regression output:

The results show estimates of the log standard deviations in the low, high, and medium volatility regimes. The implied standard deviations are 0.035, 0.176, and 0.063, respectively.

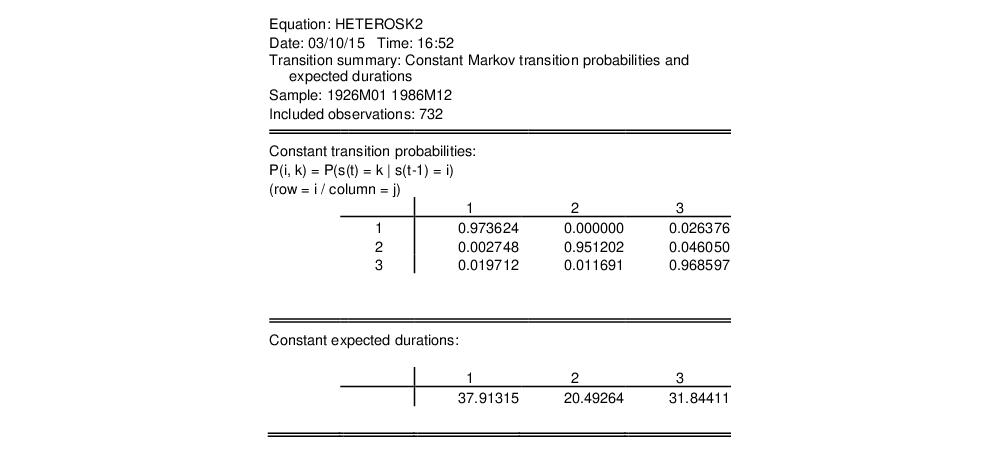

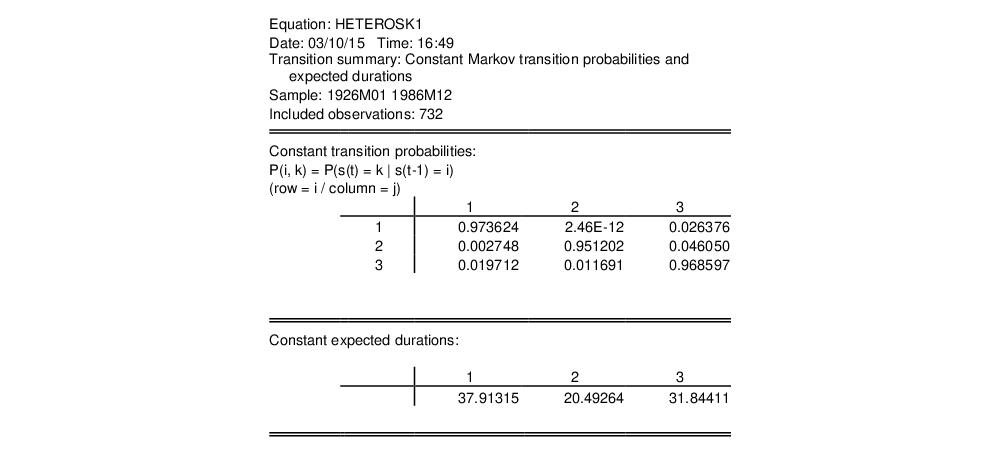

We may view the estimated transition probability matrix by clicking on and clicking on to display the summary:

The transition probabilities point to a possible explanation of the difficulty in estimating the model. The transition probability from the low volatility regime 1 to the high volatility regime 2 is essentially zero.

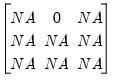

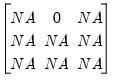

We may impose a zero restriction on transitions from the high to low state by creating a

matrix object RESTR containing:

| (39.25) |

and re-estimating the model using this restriction matrix.

One tricky aspect of imposing restrictions is that the regime identities are not fixed and can change for different starting values. Accordingly, we re-estimate the model using the prior coefficient estimates as user-specified starting values, keeping in mind that the P12-C coefficient no longer exists.

Your example workfile includes the vector object STARTCOEFS which contains the coefficient estimates from the unrestricted equation with the P12-C coefficient removed. Select from the STARTCOEFS toolbar to place these values in the C coefficient vector.

Next, go to the original equation and make a copy by selecting . Click on the button go to the tab, enter the name of the restriction vector in the edit field, and change the to . Click on to accept the changes and estimate the equation.

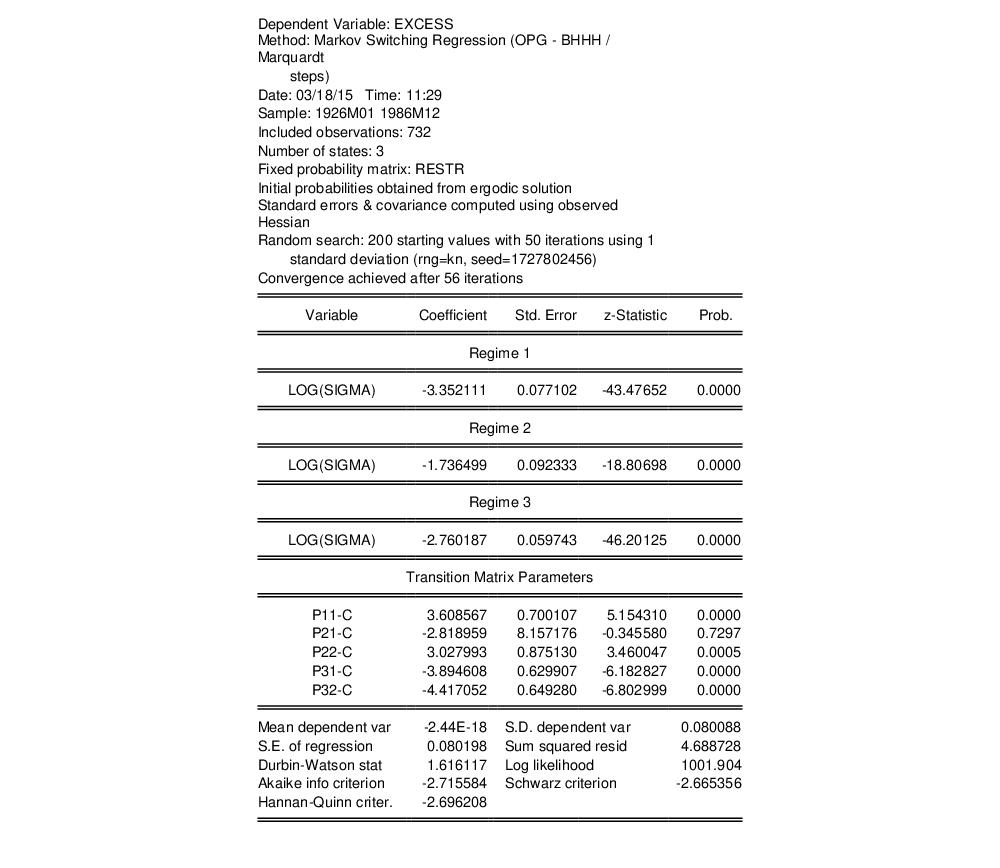

The update results are displayed below:

Note that the coefficient associated with the restricted probability

has been removed.

The transition probabilities view shows us the updated probabilities with the restricted value for

:

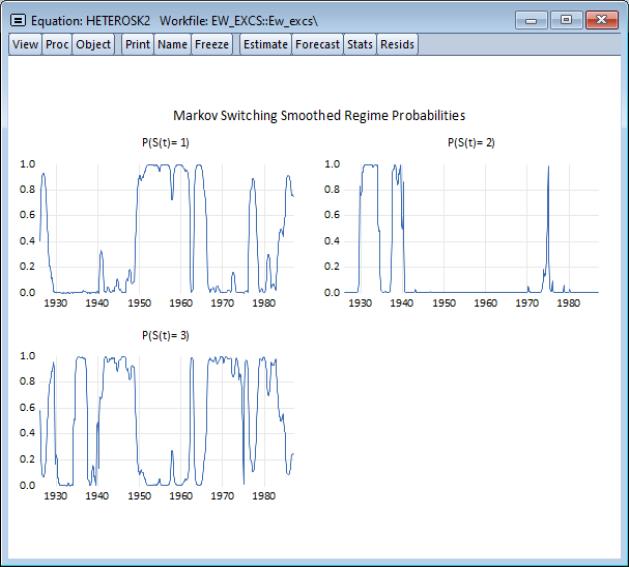

Lastly, we display the smoothed regime probabilities selecting and clicking on to accept the remaining settings. After rearranging, we have:

data for the regressor corresponds to the values influencing the transitions for

data for the regressor corresponds to the values influencing the transitions for  to

to  .

.

matrix object RESTR containing:

matrix object RESTR containing:

has been removed.

has been removed.  :

: